Top Treasury Management System (TMS) Features

In today's volatile economic landscape, can businesses truly afford to navigate financial complexities without a robust strategy? The answer, increasingly, is a resounding no. Treasury management solutions have emerged as the cornerstone of financial stability and growth, offering organizations the tools and insights needed to not only survive but thrive.

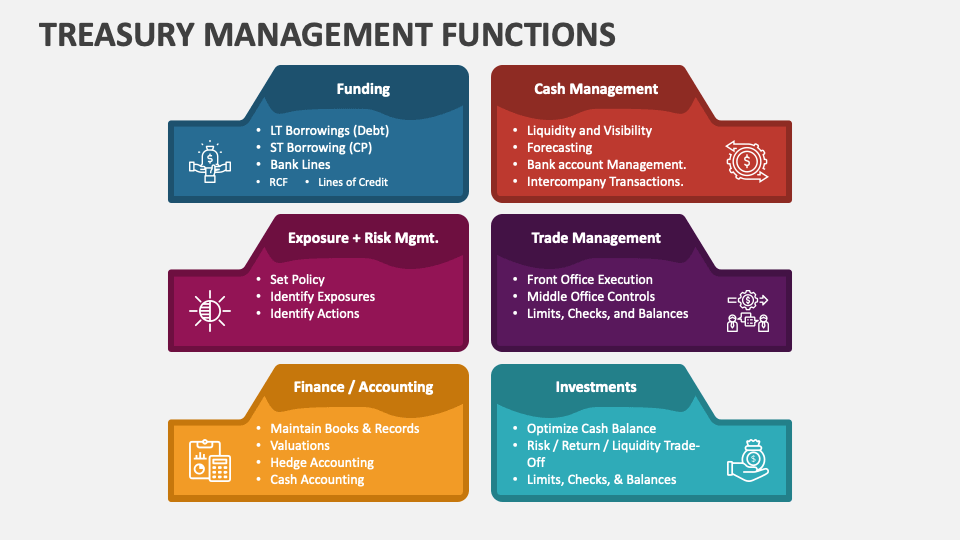

Treasury management is no longer a back-office function; it's a strategic imperative. It's about proactively managing an organization's financial resources to optimize liquidity, mitigate risks, and maximize performance. In a world of fluctuating interest rates, complex global transactions, and ever-present economic uncertainty, the ability to effectively manage cash flow, investments, and financial risk is paramount. This involves a complex interplay of forecasting, analysis, and strategic decision-making, all aimed at ensuring the financial health and resilience of the organization. And at the heart of this evolution lies the treasury management system (TMS).

| Area | Description |

| Definition | Treasury Management System (TMS) - a software solution designed to automate and streamline an organization's core treasury functions related to cash management, liquidity management, bank account management, financial risk management, and more. |

| Key Features | Cash Forecasting, Liquidity Management, Risk Management, Payment Processing, Bank Account Management, Reporting & Analytics, Compliance & Security, Integration with ERP and other systems |

| Benefits | Improved cash visibility, Enhanced control over finances, Reduced financial risk, Increased operational efficiency, Optimized working capital, Improved decision-making through data-driven insights, Streamlined financial processes, Strengthened compliance. |

| Types of TMS | On-premise, Cloud-based, Hybrid |

| Reference | Kyriba Treasury Management System |

A TMS empowers businesses to gain real-time visibility into their cash flow, enabling accurate forecasting and optimized working capital management. By centralizing payment processes and standardizing workflows, a TMS eliminates inefficiencies and strengthens control over funds. This granular level of control allows organizations to anticipate and address potential cash flow shortfalls, seize investment opportunities, and make informed decisions that drive profitability. Furthermore, a TMS plays a crucial role in mitigating financial risks, offering tools to manage currency fluctuations, interest rate exposure, and counterparty risk.

Choosing the right TMS requires a thorough understanding of the core features and functionalities that best align with your organizations specific needs. While different platforms offer unique spins, certain features are universal. Real-time tracking of incoming and outgoing funds provides a clear picture of liquidity, while centralized payment processing streamlines operations and reduces errors. The ability to forecast cash flows accurately is paramount, enabling businesses to anticipate potential shortfalls and optimize working capital. A robust TMS also provides tools for risk management, helping organizations hedge against currency fluctuations and interest rate volatility.

Beyond these core functionalities, a modern TMS offers advanced analytics and reporting capabilities, providing data-driven insights that empower strategic decision-making. Integration with enterprise resource planning (ERP) systems further enhances efficiency by centralizing financial data and streamlining accounting processes. From cash pooling and working capital optimization to fraud prevention and compliance, a TMS offers a comprehensive suite of tools designed to enhance overall financial performance.

The benefits of implementing a TMS are substantial. Improved cash visibility and control, reduced financial risk, increased operational efficiency, and optimized working capital are just a few of the advantages. By streamlining financial processes and providing access to real-time data, a TMS empowers organizations to make informed decisions, improve profitability, and drive sustainable growth. Whether you're a seasoned financial professional or just beginning your journey into treasury management, understanding the power and potential of a TMS is essential in today's complex business environment. The right TMS can revolutionize your financial operations, transforming potential challenges into opportunities for growth and success.

The landscape of treasury management is constantly evolving, with new technologies and solutions emerging to address the increasingly complex needs of businesses. From sophisticated risk management tools to AI-powered forecasting capabilities, the future of treasury management promises even greater levels of efficiency, control, and strategic insight. By embracing these advancements, organizations can position themselves for continued success in an ever-changing global marketplace.

While some solutions may be marketed as treasury management systems, it's crucial to differentiate between comprehensive platforms and those offering only limited functionality. A true TMS provides a holistic approach to treasury management, encompassing cash management, liquidity management, risk management, payment processing, and integration with other critical systems. Beware of solutions that lack key features like banking solutions, credit offerings, working capital options, and accounts payable functionality.

Investing in a TMS is not merely an expense; it's a strategic investment in the future of your organization. The cost of implementation, including upfront costs, ongoing maintenance, and potential integration expenses, should be viewed in the context of the long-term benefits. A well-chosen TMS will not only optimize financial operations but also drive growth, enhance profitability, and strengthen your organization's resilience in the face of economic uncertainty.

Detail Author:

- Name : Pascale Bashirian

- Username : chessel

- Email : maryjane.murray@hotmail.com

- Birthdate : 1998-06-10

- Address : 374 Brady Parkways West Kane, CO 96298-9198

- Phone : 919-206-2913

- Company : Robel-Kirlin

- Job : Entertainer and Performer

- Bio : Sunt numquam mollitia fuga mollitia. Totam illo ut quis nihil hic sed. Corporis a cupiditate nostrum. Quod aliquam qui delectus ut.

Socials

linkedin:

- url : https://linkedin.com/in/kilback1979

- username : kilback1979

- bio : Iusto id reiciendis commodi et.

- followers : 2129

- following : 662

facebook:

- url : https://facebook.com/kilbackg

- username : kilbackg

- bio : At id ea praesentium distinctio tempore ea. Sit vitae et tempore incidunt.

- followers : 5381

- following : 2370

instagram:

- url : https://instagram.com/geoffrey_official

- username : geoffrey_official

- bio : Hic nulla sit eaque rerum autem ipsam qui consequuntur. Accusantium sed est soluta dolorem.

- followers : 3066

- following : 692

tiktok:

- url : https://tiktok.com/@geoffrey.kilback

- username : geoffrey.kilback

- bio : Exercitationem perspiciatis sint recusandae sunt.

- followers : 6551

- following : 1405