Top Treasury Management Systems 2024

In today's volatile financial landscape, can businesses truly afford to neglect the strategic power of treasury management? Absolutely not. Effective treasury management is the bedrock of financial health, ensuring stability, driving growth, and ultimately, determining a company's success.

Treasury management isn't just about counting pennies; it's about strategically orchestrating every aspect of a company's financial resources. This encompasses cash flow optimization, meticulous risk mitigation, shrewd investment management, and maintaining a healthy balance of liquidity. In an era of increasing complexity, with fluctuating global markets and evolving financial regulations, robust treasury management is more crucial than ever. It empowers businesses to navigate uncertainty, capitalize on opportunities, and maintain a competitive edge.

| Feature | System A | System B | System C |

|---|---|---|---|

| Cash Forecasting | Yes | Yes | Basic |

| Risk Management | Advanced | Standard | Limited |

| Bank Integration | Multiple Banks | Limited Banks | No |

| Payment Processing | Yes | Yes | Limited |

| Reporting & Analytics | Customizable dashboards | Standard reports | Basic reports |

Kyriba Treasury Management (Example Link)

Treasury management solutions offer the scalability necessary to handle the demands of modern business. Whether it's managing escalating transaction volumes, incorporating new accounts, or expanding into international markets, a robust treasury management system (TMS) ensures efficiency remains uncompromised. Automation lies at the heart of these solutions, streamlining processes, reducing the need for manual intervention, and minimizing costly errors. This not only saves valuable time and resources but also strengthens financial control and reduces operational expenses.

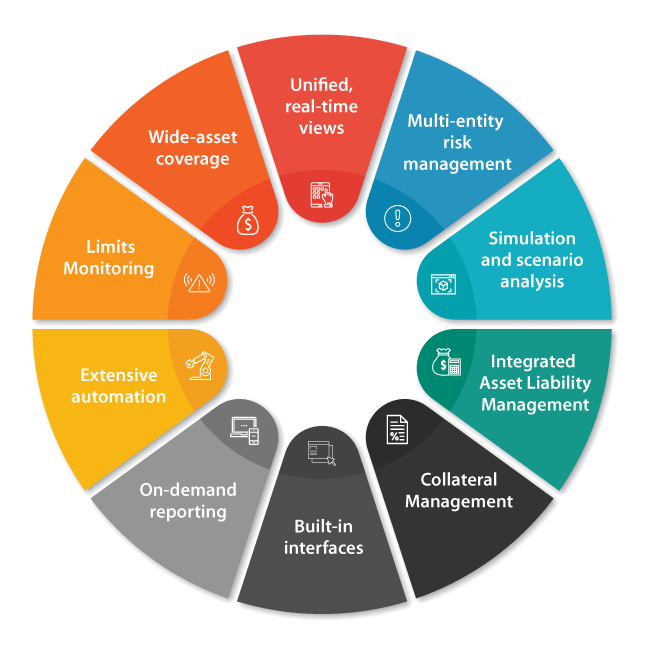

An integrated TMS provides a centralized hub for all financial operations, offering unparalleled visibility and control over financial assets. This comprehensive oversight allows businesses to make informed decisions, optimize liquidity, and proactively manage financial risk. Key features to look for in a best-in-class TMS include sophisticated cash forecasting, robust risk management tools, seamless bank integration, streamlined payment processing, and comprehensive reporting and analytics capabilities. Selecting the right TMS involves a thorough assessment of these capabilities to ensure they align with the specific needs of the organization.

A TMS is more than just a software solution; it's a strategic investment that can significantly impact a company's bottom line. It empowers businesses to take control of their financial destiny, mitigating risk, optimizing liquidity, and driving sustainable growth. From automating mundane tasks to providing real-time insights into financial performance, a TMS is an indispensable tool for any organization striving for financial excellence.

A strong TMS offers core features such as cash management, liquidity planning, financial transaction processing, and bank relationship management. These integrated tools enable businesses to optimize working capital, manage cash pools effectively, and prevent cash shortfalls. By centralizing treasury operations, a TMS streamlines workflows, minimizes repetitive processes, and reduces the risk of errors.

Effective treasury management is not an arcane art but a learnable skill. It involves planning and organizing all financial aspects of a company to ensure funds are utilized optimally, liquidity is maintained, the overall cost of funds is reduced, and both operational and financial risks are mitigated. Inaccuracies in treasury management processes can have significant consequences, highlighting the importance of implementing robust systems and procedures.

The benefits of using treasury management software are substantial. From enhanced efficiency and improved insights to robust risk mitigation, a TMS offers a significant return on investment. By automating tedious tasks, streamlining workflows, and providing real-time visibility into financial data, a TMS empowers treasury teams to focus on strategic initiatives and drive value for the organization. Beyond the core functionalities, leading TMS platforms offer advanced features such as debt and investment management, supporting portfolio optimization and tracking payments and maturity dates. They also provide sophisticated risk management capabilities, helping identify and mitigate financial risks, such as interest rate and foreign exchange fluctuations, through hedging strategies.

In the dynamic landscape of modern finance, treasury management is not merely a buzzword but a critical component of a company's financial health. It's the engine that drives financial stability and fuels sustainable growth. By embracing the power of treasury management and leveraging the capabilities of a robust TMS, businesses can navigate complexity, seize opportunities, and secure a prosperous future.

Selecting the right treasury management software requires careful consideration of key features such as cash forecasting accuracy, risk management capabilities, bank integration options, payment processing efficiency, and reporting and analytics functionalities. A true TMS should offer a comprehensive suite of tools to support all aspects of treasury operations, from cash management and liquidity planning to risk mitigation and investment management. Some platforms masquerading as TMS solutions may lack essential features, such as banking solutions, credit offerings, working capital options, and accounts payable functionality, limiting their effectiveness in addressing the full spectrum of treasury management needs. Therefore, a thorough evaluation of the software's capabilities is crucial to ensure it aligns with the organization's specific requirements and long-term objectives.

Detail Author:

- Name : Dr. Destiny Lebsack

- Username : leannon.darwin

- Email : okuneva.meagan@yahoo.com

- Birthdate : 1979-12-20

- Address : 8763 Sporer Gardens Domenickville, TN 84443

- Phone : 620.512.4996

- Company : McDermott LLC

- Job : Home

- Bio : Beatae laudantium sequi sapiente et rerum ducimus excepturi esse. Corrupti aliquam quas sit quia. Illo quas aspernatur soluta qui dolor. Qui non ipsum debitis labore saepe eum aut.

Socials

instagram:

- url : https://instagram.com/kadin_rodriguez

- username : kadin_rodriguez

- bio : Dolores quae labore quasi ab laboriosam necessitatibus. Aut labore qui vel.

- followers : 2150

- following : 1659

twitter:

- url : https://twitter.com/krodriguez

- username : krodriguez

- bio : Quos commodi fugit eos est temporibus. Voluptatum minus officia quia distinctio architecto illo. Facilis minus mollitia qui eligendi nisi.

- followers : 6488

- following : 1501

tiktok:

- url : https://tiktok.com/@kadin_xx

- username : kadin_xx

- bio : Sit quasi quidem quos animi ipsa est eaque a.

- followers : 2017

- following : 1130

linkedin:

- url : https://linkedin.com/in/rodriguez1992

- username : rodriguez1992

- bio : Dolorem neque aut qui.

- followers : 1135

- following : 2634

facebook:

- url : https://facebook.com/kadin2020

- username : kadin2020

- bio : Et minima accusamus eos earum magni.

- followers : 5618

- following : 17